Research Note

February 2023 Network and component makers face a subdued ICP/CSP spending outlook, after double-digit growth in Q4 2022

Abstract

Financial results for Q4 2022 have now been reported by most western service providers, components vendors and network equipment makers, and are summarized in a Research Note published today by LightCounting Market Research.

In almost all cases, revenues of components and equipment makers grew at double-digit rates compared to Q4 2021. In contrast, both ICPs and CSPs reported slowing growth in key business areas, continued layoffs, and guided toward a moderation in spending growth in 2023.

This discrepancy in growth rates will not last for much longer. The equipment and component suppliers have benefited from a heavy order backlog, accumulated over more than two years of supply chain bottlenecks and IC shortages. Well diversified suppliers, such as Coherent and Lumentum, may not see a sharp drop in their business. Smaller businesses, selling products to very large Cloud companies, will report significant declines in 2023.

Credo Technology is the first example of many more to come. It issued a statement this week that a major customer (believed to be Microsoft) had significantly reduced orders, and its market valuation was reduced by more than $1 billion (1/3 of total) the next day. Credo will report financials on Q4 2022 on March 1. Its new revenue target of $31 million represents a decrease of 40% compared to the record $51 million reached in Q4 2022.

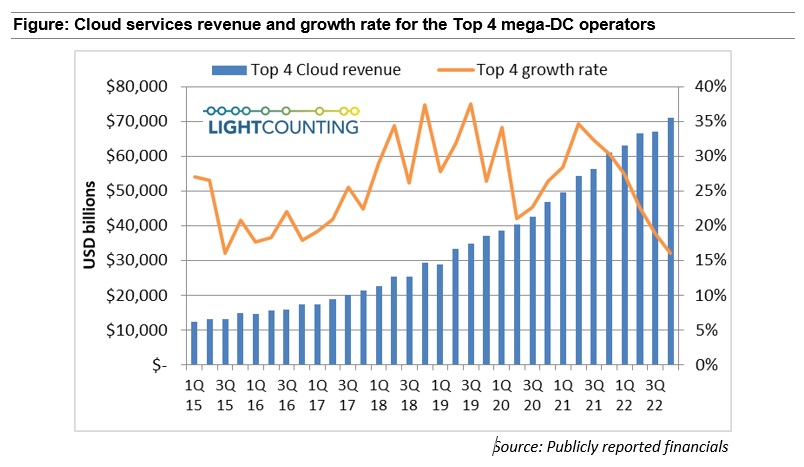

Cloud services revenues are a very important indicator of future demand for data center equipment and optics. The data for Alphabet, Amazon, Apple, and Microsoft is clear – cloud revenue growth is slowing down.

This is true for each of the Top 4 individually as well as for their combined revenues. CSPs have guided for flat to declining capex for 2023 as well.

Coherent and Lumentum, the two leading western optical components vendors, have both reported their Q4 financials. Coherent reported organic growth of 23% y-o-y and 4% sequentially, with its Communications segment revenues up 18% year-over-year.

Lumentum’s revenue in Q4 2022 was up 13.3% year-on-year. Optical Communication segment revenue decreased 1% sequentially, due to decline in Industrial and Consumer. The other sub-segment, Telecom and Datacom was up 44% year-on-year driven by Telecom. Edge networking products were up 40% year-on-year and have become a major component of the company’s Telecom business.

Lumentum said it continues to be limited by supply shortages of ICs from third parties, resulting in $60 million of unsatisfied customer demand in Q4, which is a modest improvement from the $80 million gap articulated in its last earnings call.

Equipment makers nearly across the board also reported good results for Q4 2022, with almost universal double-digit growth in sales.

These early financial results for Q4 2023 are discussed in greater detail in the Research Note published by LightCounting today, which is available to subscribers at: https://www.lightcounting.com/login.