Research Note

November 2022 Cost cutting among the top customers is an early warning for the industry supply chain

Abstract

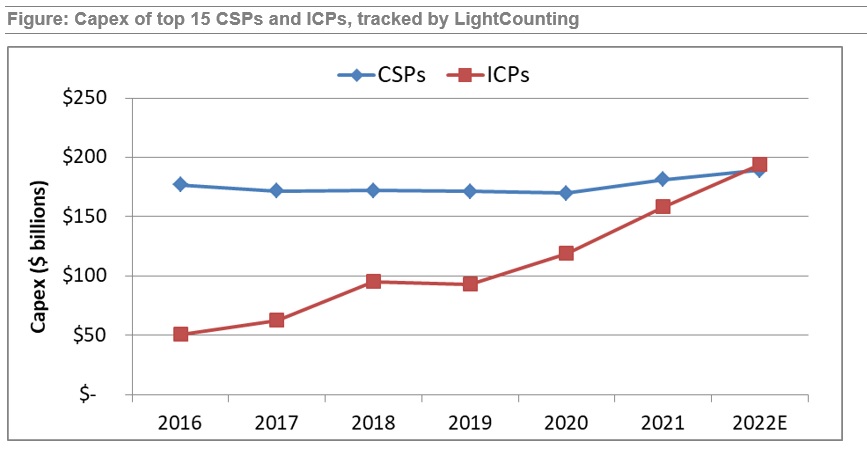

LightCounting reported earlier this year that 2022 will be the year of the crossover, as spending of top 15 Internet Content Providers (ICPs) exceeds capex of top 15 Communication Service Providers (CSPs), tracked by LightCounting. The actual growth in 2022 spending may be a bit lower since many ICPs and CSPs are taking a closer look their spending after reporting weaker than expected Q3 financials, but the crossover in 2022 is still very likely.

The problem is that 2023 may bring a crossover in the opposite direction, if ICPs reduce their spending plans sharply next year. We have seen this in 2019, as illustrated in the figure below.

Market valuations of ICPs are down sharply in 2022. Meta’s stock is down 70% for the year, Alphabet and Amazon are down 30-50%. This puts a lot of pressure on the companies to reduce their spending to please the investors. Meta announced the first mass layoff in the company’s history, reducing their staff by 11,000 people or 13% of the workforce. Alphabet’s CEO has set a high priority goal of getting 20% more productivity from its existing employees and to slow the pace at which it adds new team members. Amazon has a hiring freeze on corporate positions and is only staffing up order fulfillment and logistics positions for the holiday season rush.

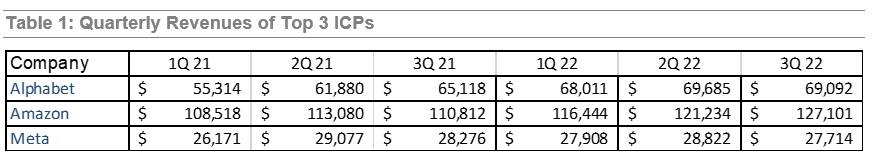

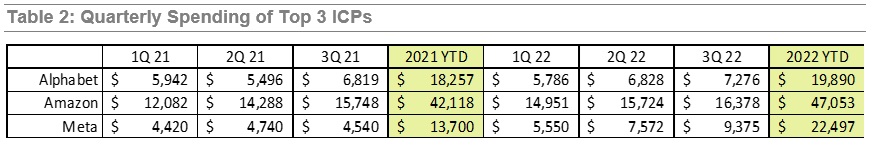

Tables 1 and 2 illustrate quarterly revenue and spending reported by the top 3 ICPs. Growth in advertising revenues is slowing down at Alphabet and Meta’s revenues declined in Q1 and Q3 of this year.

By comparing the same three ICPs’ capital spending in the first three quarters of 2021 and 2022 in Table 2, we see lumpiness sequentially, but we very clearly see that the capital spending year to date is up significantly. The magnitude of the capital spending increases is staggering. Alphabet has spent over $1.6 billion more so far in 2022 than it did in the first quarters of 2021; Amazon has spent almost $5 billion more so far in 2022 than it did in the first quarters of 2021; and Meta has spent almost $9 billion more so far in 2022 than it did in the first quarters of 2021.

Meta stated publicly that it will continue to invest more in datacenters next year, but their forecast for spending on 200G FR4 transceivers in 2023 was revised significantly. Meta is on track to purchase more than 3 million of these modules in 2022 and their original forecast for 2023 was 5-6 million units. The latest guidance suggests only 3 million for next year – flat in terms of units, compared to 2021, and probably 15-20% lower in terms of sales because of acceleration in price declines.

Lumentum reported a sequential decline in EML revenue due to lower demand by a subset of cloud data center customers (most likely Meta and possibly Amazon). The company anticipates continued softer demand for the next two quarters, since transceiver suppliers must have excess inventory of EMLs as their key customers reduced forecasts for next year.

Lumentum and Coherent are still reporting supply chain bottlenecks, limiting growth in sales by $60-80 million per quarter. If the supply chain situation improves in early 2023, it may offset lower growth in sales of datacom optical transceivers and components for them.

The full text of the research note is available to LightCounting subscribers by logging into their accounts at: https://www.lightcounting.com/login.